The Evolution Of QSR

Driven by habits developed during, and post pandemic, the QSR industry has evolved significantly in the last 2 years, with the majority of change being driven by changing consumer habits, a collective labour shortage and a need to reduce operating overheads. The majority of all change is enabled by the ongoing digitalisation of the marketplace. Here we share our thoughts on how the QSR marketplace is evolving, and how restaurant brands can invest to evolve their service offering, to meet the growing needs of the consumer.

SPEED OF SERVICE

The Quick Serve Restaurant industry is highly competitive. It’s a cliché to say that ‘speed wins’ but that’s the reality you have to deliver with when dealing with hungry and busy consumers, who now have more choice and methods of purchase than ever before. By investing in ‘speed of service’ you’ll be able to maximise your conversion rate, drive ATV and ensure that your restaurant never misses a sale.

Recently, we’ve seen the opening of a new QSR concept from TACO BELL – a restaurant so unique it doesn’t even have a dining area. Why? Because its purpose is to fulfil mobile and drive-thru orders. Eat at home has been a booming industry in recent years, and this concept from TACO BELL is a great example of how the QSR market is evolving to meet consumer demand.

Two years ago, during the pandemic – the majority of all QSR drive-thru’s in the UK essentially operated using this model, as dine-in eating wasn’t allowed due to social distancing restrictions. Much was learned during this period – not to mention how to manage queuing traffic around the restaurant and on adjacent roadways.

Many consumers have now developed a habitual ‘trust’ for ordering via digital touch-points, such as kiosks, delivery apps and mobile apps. In many ways it is the consumer that dictates how the QSR marketplace of the future will look, digital touch-points and innovation will create speed and ease of service – some will become more successful than others, with consumer adoption of such tools being the key success factor.

Queues can be a blessing. they indicate demand. If you have queues at your restaurant, it’s easy to calculate missed opportunity – audit how many people join a queue and then walk away, multiply this by the average transaction value and you’ll quickly work out how much business you’re missing. Customers are prepared to wait for their food – they’re not prepared to wait to order it.

EAT AT HOME:

There’s an increasing trend for consumers to dine at home, a clear hangover from the pandemic. Consumers are choosing to take-out more as it’s a method of service that ticks many boxes, for busy individuals and families.

Digital channels promise to enhance, rather than undermine, brick-and-mortar locations; digital drive-thrus demonstrate how tech solutions can elevate traditional ordering channels. And these kinds of integrations are in high demand, you can characterise takeout eaters as tech-savvy, confident about managing their data, which clears a path for more personalisation. McDonald’s is currently experimenting with automated voice ordering and the company plans to offer customised menus via license plate recognition, which relies on diners’ willingness to share personal information.

Online diners are harder to please. They’re more fickle and likely to choose a QSR based on offerings like discounts or rewards. Exclusive content is also a stronger purchase driver, which suggests more potential to divert users to alternative offerings via online checkouts and up-sell opportunity.

CURB-SIDE PICK-UP

The epitome of efficiency. Place your order on the mobile app. Pay. Drive to your nearest drive-thru, mobile tracking knows when you are getting closer to the restaurant, drive into the drive-thru lane or pick-up point, a camera scans your number plate – and order is passed to you. Fresh, Hot, and speedy – what’s not to like?

This is a popular system, already used in the U.S, specifically by McDonald’s. This is not a new concept, but a growing service channel, to service the consumer’s needs.

As consumers become more comfortable with the variety of ordering and service methods available to them, expect this to be a more common service standard for the majority of QSR brands.

DIGITISATION AND AUTOMATION:

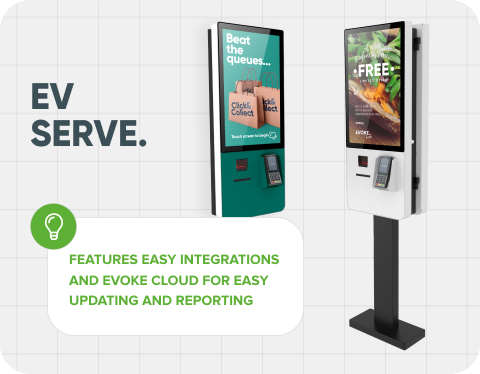

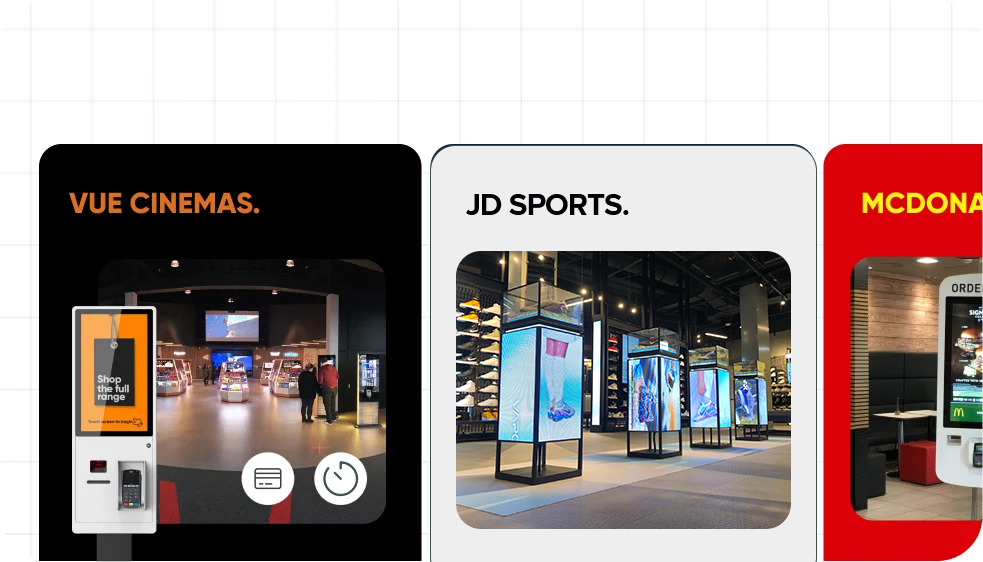

Labour shortage and high staff turnover is making it harder to recruit, train and retain staff. This is forcing QSR brands to move away from a physical workforce to maintain operational output. Self-service kiosks have been a staple sight in many QSR restaurants (our tech is the leading standard) due to the speed, efficiency and uplift in ATV that they deliver.

Recently. U.S burger chain White Castle, introduced ‘Flippy 2’ in November 2021, a kitchen robot that can carry out a range of food preparation tasks, that can boost productivity or perform dangerous tasks, such as using THE hot oil fryer, leaving more delicate and safer tasks to the human work force.

Although many restaurant chains already have digitised their processes, many more have room to grow. Simply put, restaurants cannot continue to play a frantic game of tech catch-up with their competitors. It isn’t about leapfrogging each other, time after time. The pandemic was the wake-up call that shook the industry into realising that the future of QSR truly is digital.

INCREASED DWELL TIME:

As the QSR marketplace evolves, will we see a brand challenge the very meaning of the term? By that we mean quick. But what if the consumer doesn’t want quick? What if they want to dine in, dwell, and do some work, and speed isn’t a priority? As many professionals are still working a flexible work pattern, a mix of office + home working is becoming the norm. Many businesses are now evaluating the need for, or the size of, their office spaces.

As the need for flexible workspaces increases, might we see a QSR brand see this as an opportunity to create a new restaurant format? One that caters for professional workers, a bigger and more expansive restaurant space – with workspaces and bookable rooms? A space where a user can order breakfast, lunch and refreshments to their workspace or meeting room.

These types of spaces would be best placed in city centre locations, near to transport hubs, to attract the high passing footfall of busy professionals. At a time when there are high vacancy rates in these areas or on the high street, finding a suitable property to deliver this type of restaurant format, wouldn’t be difficult.

A strategy of this sort would see a traditional QSR outlet, evolve towards more of a CFR format. This complements the trend in recent years for many CFR restaurants, to offer a more traditional QSR service from their menu, through partnerships with Deliveroo, or by investing in ordering kiosks.

INVEST AND EVOLVE:

As McDonald’s implements their ‘convenience of the future’ strategy, expect to see many of their out of town restaurants, close temporarily for refurbishment upgrades, redefining interior service areas, kitchen space and dining areas, to cater for the ever-changing demands of the consumer.

Expect to see further significant change and investment in the industry – from all major brands.

If you’re a QSR or CFR restaurant brand, and want to discuss how to evolve your business and service proposition with digital tools – get in touch with our experts!